Black homeowners, make sure your mortgage lender treats you humanely

How mystery shopping prepared me for housing discrimination

I almost didn’t buy my home. I was told I couldn’t afford it. I knew I wanted to move out of my condo rental after a terrible experience, but I thought it might be a long shot due to my student loans and car loan. Still, I tried anyway. My money obstacle ended up being neither of those expenses. Instead, my mortgage lender sent a group email saying I was at financial risk due to a Kohl’s credit card balance.

My first thought: “Are you kidding me? I went to two different undergraduate universities, graduated from an HBCU and changed my major three times in grad school, but Kohl’s was what was holding me back from being a homeowner?” I shrugged my shoulders and almost tapped out.

Then my Realtor, a Caribbean woman, shook her head and said to me, “This is not normal. I’m not supposed to know about your department store debt.” As a first-time home shopper, I thought it was perfectly normal for the mortgage lender to tell her this. After all, from my brief overview online, everyone involved worked as a team. The seller and the seller’s Realtor were in communication with the buyer and the buyer’s Realtor. The Realtor was in communication with me, my mortgage lender and my real estate attorney. In my mind, we’d be a big, professional, happy family.

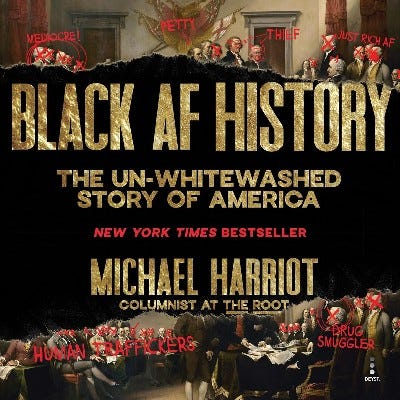

ADVERTISEMENT ~ Amazon

As an Amazon affiliate, I earn a percentage from purchases with my referral links. I know some consumers are choosing to boycott Amazon for its DEI removal. However, after thinking about this thoroughly, I want to continue promoting cool products from small businesses, women-owned businesses and (specifically) Black-owned businesses who still feature their items on Amazon. As of the first date of Black History Month 2025, each new post will ALWAYS include a MINIMUM of one product sold by a Black-owned business. (I have visited the seller’s official site to verify that Amazon Black-owned logo.) I am (slowly) doing this with older, popular posts too. If you still choose to boycott, I 100% respect that decision.

Upside and downside of choosing a mortgage lender blindly

I thought it was peculiar that this department store card balance wasn’t a personal conversation with me first though. Then I started noticing a few other things — snippy emails from the mortgage specialist with a “you should know this already” tone for asking monetary questions. Then the condescension started escalating to my Realtor. Now how am I supposed to buy this place if the mortgage rep is being hostile to the woman representing me and then leaving my attorney out of the loop too?

Recommended Read: “The hidden value of mystery shoppers ~ Why secret shopper Intel still surpasses customer survey data”

In any other circumstance, the Realtor can assist a home buyer with finding a mortgage company to work with. (My Realtor already had three other companies in mind.) They’re already familiar with this industry and may know the best financial institution to work with. But I saw how smoothly a co-worker’s purchase went and made up my mind that I’d use his mortgage lender.

ADVERTISEMENT ~ Amazon

As an Amazon Affiliate, I earn a percentage from purchases using my referral links.

As my purchase started to unfold, and I told him about what was going on, I kept noticing a pattern—he was blaming me for everything.

“I didn’t get asked those questions.”

“Well, maybe you’re arguing with him.”

“He didn’t treat me like that.”

“Are you getting an attitude with him?”

If you’re noticing an undertone to the questions, trust me, I did too. I looked at my co-worker, a racially ambiguous man with a racially ambiguous name who was married to a white woman and thought, “Gee, what could be the difference between me, you, and my black female attorney and black female Realtor?”

To make the situation even worse, I was already getting this same sort of treatment from my boss at the time, but I needed this job badly in order to get the loan. The last thing I needed to do was ruffle her feathers at the same time I was trying to close on a six-digit deal. So instead of losing my temper, I called my mortgage specialist up and asked him to tell me and me only if there was some kind of financial problem with my credit score. His response? Impatience and indifference. I paused for a minute, blinked, thought about all the odds against me (hated my condo rental, despised my boss, mortgage specialist was being a jerk) and said in an even tone, “Cancel the deal.”